It is a service that allows consumers to have control of their Credit Report, Xcore Predictivo, personal data, monitoring of the queries that third parties make about them, as well as viewing the associated addresses and telephone numbers, so that they can stay up to date. of each update or change that occurs around your data.

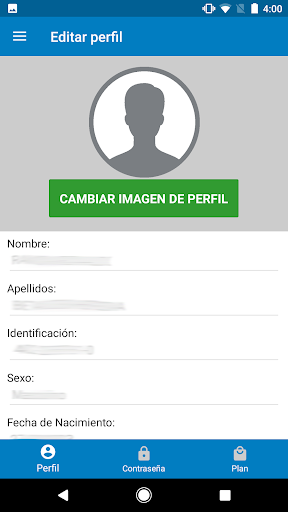

MiData is the app through which the company CONSULTRORES DE DATOS DEL CARIBE, SRL (DATACREDITO) offers consumers the Credit Report and the Credit Xcore.

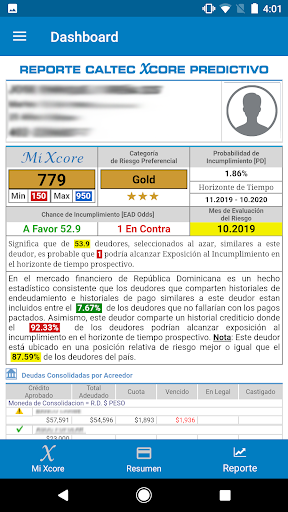

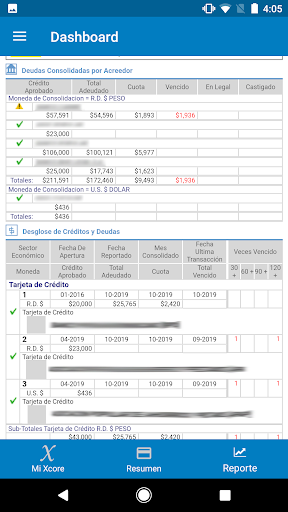

Credit Report: It is a detailed report that shows the balances and status of credits of various kinds (consumer, mortgage or vehicle) opened by the consumer in a period of time not exceeding 4 years, according to what establishes Law No. 172-13 of the Dominican Republic.

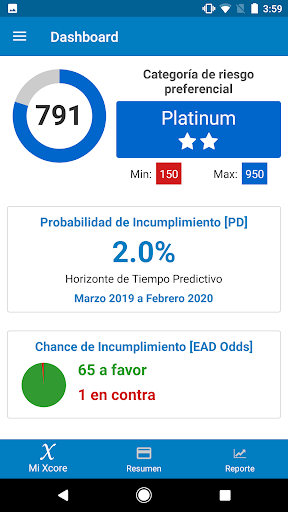

Xcore: It is a score that predicts the probability of default in the payment of financial obligations (loans, credit cards and other services). It is calculated using mathematical and statistical models, based on five (5) categories of variables: payment history, amounts owed, recent credit performance, types of credit in use, and length of credit history.

Promotions and/or Credit Offers:

Application of consumer loans:

- Interest rates for consumer loans: From 8% to 30% * annually

- Loan amount: RD 15,000.00 to RD 500,000.00

- Processing fee: 0% to 6% of the loan amount

- Loan tenure: from 3 to 60 months

Representative Example of the Loan:

Amount Requested: RD 50,000.00

Maximum Term: 90 days (3 months)

Interest Rate: 18% Monthly Fee

: RD 17,169.15

Total Payable RD 51,507.45

Through the MiData application we connect consumers with Financial Institutions that can make credit offers attached to the following policies:

- Consumers must be citizens of the Dominican Republic.

- Does not apply to RNC, does not apply to passports, does not apply to consultation with third parties, only personal.

- Consumers must be affiliated with MiData.

- Financial Institutions must adhere to the laws and regulations of the Dominican Republic.

- Financial Institutions will only submit credit offers for the following products:

- Consumer loans.

The rates that will be offered for consumer loan promotions will be the following and will never be higher than the maximum rate issued by the Superintendency of Banks of the Dominican Republic for this type of product: Minimum rate 1% Maximum rate

36

%

The period of time to grant consumer loans will never exceed the minimum or maximum limits established by the Superintendence of Banks of the Dominican Republic for this type of product: - Minimum

period of 3 months

- Maximum period of 60 months

The type of amortization that must be used by the Financial institutions granting credit offers through MiData for consumer loans and credit cards will be those established by the Superintendency of Banks for this type of product.

For more information on privacy policy and data use: https://midata.do/politicaPrivacidad

For more information on terms and conditions: https://midata.do/terminosLegalesView

Notification fixes.

Bug fixes when activating and deactivating notifications.

Cambios en las reclamaciones.

Esta versión elimina todo tipo de transacciones de pago.

Actualización para las Promociones.

Introducción del menú de promociones dentro de la app.

Release 47

Release 44

BLU S1

BLU S1